Vet practice sales are becoming more common as long-time clinic owners look for a clean exit after years of hard work. A 2024 study published in Frontiers in Veterinary Science surveyed 1,256 small animal clinicians and found that 31% plan to stop clinical work entirely within the next five years. [1] The primary reasons cited were the desire for more personal time (76%), maintaining good health (59%), and feelings of burnout (50%).

If you’re one of them, going through a sale can feel like stepping into unknown territory, but the right preparation changes everything. This guide is built for clinic owners who want a clean, profitable exit without losing control of what’s built. It breaks down how the process works, how long it takes, and what to expect along the way.

We’ve included examples, clear timelines, and practical insights, so you can make wise decisions from day one.

Are You Ready to Sell Your Vet Clinic?

Selling a veterinary practice clinic isn’t something you decide overnight. It usually builds up over time with quiet signs like:

- Feeling drained after routine admin work

- Skipping strategic decisions

- Watching paperwork pile up

- Thinking more about stepping back than scaling up

- Feeling that you’ve taken the clinic as far as you can

- Noticing that leading the team drains more energy than treating pets

Sometimes, it comes after talking with peers who’ve already exited. Other times, it starts with a single offer that makes you pause. Knowing where you are in the process matters if you want to learn how to sell your vet clinic or prepare actively to exit. There isn’t a universal checklist, but there are questions worth asking.

Am I Ready? Ask Yourself:

- Have I thought through my goals post-sale?

- Are my clinic’s finances organized and up to date?

- Am I emotionally ready to let go of daily control?

- Do I understand what buyers are looking for?

- Have I talked to anyone who’s sold their practice before?

Every veterinary business sale process is different, but the one constant is this: the sooner you prepare, the more options you’ll have.

Quick-Glance: Should You Sell or Wait?

| Good Time to Sell | Better to Hold Off |

|---|---|

| You’re planning retirement | Clinic is in mid-expansion |

| You feel done with managing | Still motivated to lead |

| Buyer interest is strong | Market conditions are weak |

| Staff turnover is rising | Just built a solid new team |

How Much Is Your Veterinary Practice Really Worth?

Valuing a vet clinic isn’t just about total revenue. A buyer is more interested in knowing how profitable your business is than knowing how much revenue it makes. That’s where EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) comes in. Simply put, it’s your clinic’s clean operating profit before accounting for financial structure or one-off expenses.

Revenue multiples are another method used, though less precise. This approach examines your annual income and applies a general industry multiplier to estimate the sale price. It’s quicker but doesn’t reflect how efficient or profitable your clinic really is.

Most serious buyers, especially corporate groups, prefer using EBITDA to see value. They’ll usually apply a multiple based on your clinic size, location, growth, and risk. In the current U.S. market, the average EBITDA ranges from 4x for smaller practices to 8x or more for large, multi-DVM clinics.

Let’s break it down with a few examples.

Sample Valuation: Solo vs. Multi-Vet

| Clinic Type | Annual Revenue | EBITDA | Multiplier Used | Sale Estimate |

|---|---|---|---|---|

| Single DVM Practice | $900,000 | $100,000 | 4.5x | ~$450,000 |

| Multi-Vet (3–4 Veterinarians) | $2.8M | $550,000 | 6x – 10x | ~$3.3M – $5.5M |

| Well-Run Urban Clinic | $4.5M | $950,000 | 10x – 15x | ~$9.5M – $14.25M |

Here’s how EBITDA works:

You take your net income and add back expenses that don’t reflect your day-to-day operations like depreciation and interest. That total is your EBITDA. Then, you apply a multiplier, often based on your clinic’s size, profitability, and market demand.

For example, a small single-vet practice might sell for 4.5x or 5x your EBITDA whereas a well-run, multi-veterinarian clinic in a metro area could go for 10x or higher.

Sample Calculation:

Let’s say your vet clinic earns $100,000 in net income every year. Presume that you also had $20,000 in depreciation, $10,000 in interest, and $5,000 in taxes.

- The EBITDA would be: $100,000 + $20,000 + $10,000 + $5,000 = $135,000

- If your vet practice gets a 8x valuation: $135,000 × 8 = $1.08 million is the estimated sale price

| Note: Two clinics with the same revenue might have very different values depending on their expenses, staffing, and growth outlook. That’s why profit (and not just income) tells the real story. |

What Impacts a Vet Clinic’s Sale Price

Valuation isn’t just about annual revenue. Buyers look for signs of consistency, low risk, and growth potential. Some of the biggest variables that affect your practice’s sale price aren’t always obvious at first glance.

1. Revenue Spread Across Multiple Veterinarians

If the clinic’s income depends mainly on one veterinarian, the risk profile goes up. Buyers prefer clinics where production is distributed across multiple veterinarians. This structure signals operational stability and reduces concern about future drop-off if a single provider exits. A practice that shows consistent productivity across three or more vets is often viewed as more transferable and more attractive in the long run.

2. Number of Exam Rooms and Facility Capacity

A clinic’s infrastructure directly affects what it can handle today and how much more it could take on tomorrow. The number of exam rooms is a strong indicator of both current workflow and future growth.

A vet practice with four or more fully equipped exam rooms allows for multiple veterinarians to work efficiently and supports a higher client volume. If the space is already being used at full capacity, buyers will also consider how easily the facility can be modified or expanded.

3. Real Estate Terms and Ownership Clarity

Ownership of the clinic property is less important than how cleanly it fits into the sale structure. Buyers will want to know if the clinic is operating under a lease, and if so, whether the terms are transferable and stable. If the building is owned, it helps to clarify upfront if it’s included in the sale or to be handled as a separate agreement.

4. Staff and Client Retention Over Time

Buyers pay close attention to how long your staff has been with you and how strong the client relationships are. If there’s been constant turnover or missing roles that haven’t been filled in months, it raises concerns.

On the other hand, when a clinic has a good team that’s been around for years, it signals that the business runs well day to day. It also means the new owner won’t be walking into staffing issues right after the handover. Long-term clients add to this picture too, as they point to consistent demand and reliable income.

How Long Does It Take to Sell a Vet Practice?

In most vet practice sales, the full process, from prepping your documents to closing the deal, takes about 2.5 to 3 months. The timeline still depends on how organized your books are, the strength of your finances, and how flexible you are during negotiations.

Some deals happen faster, but most follow a step-by-step veterinary business sale process that can’t be rushed. If your clinic is in high demand, with good profits and a clean setup, you might find a buyer within a few months. But if you’re still sorting paperwork, waiting on a lease renewal, or not clear about your post-sale role, expect it to take longer.

External factors can also influence timing. Changes in borrowing rates, tighter lending standards, or broader economic uncertainty often slow down deal flow across the board. Owners who understand how the economy can impact the sale of veterinary practices are better equipped to plan and catch the market at the right moment. [2]

If you’re an owner learning how to sell your vet clinic correctly, it’s worth knowing what can speed up or slow down the process.

Breakdown of a Veterinary Practice Sale Timeline

| Timeline | Stage | What Happens |

|---|---|---|

| Month 1 | Pre-market preparation | – Align on goals and expectations – Review financials and clinic setup – Gather important documents – Define the ideal type of buyer |

| Month 2 | Confidential marketing and bidding | – Share the clinic confidentially with qualified buyers – Hold early conversations and answer questions – Review multiple offers side by side |

| Month 3 | Selection, Due diligence, and closing | – Pick the strongest offer and sign an LoI (Letter of Intent) – Work through due diligence – Finalize contracts and legal docs – Close the sale and prepare for transition |

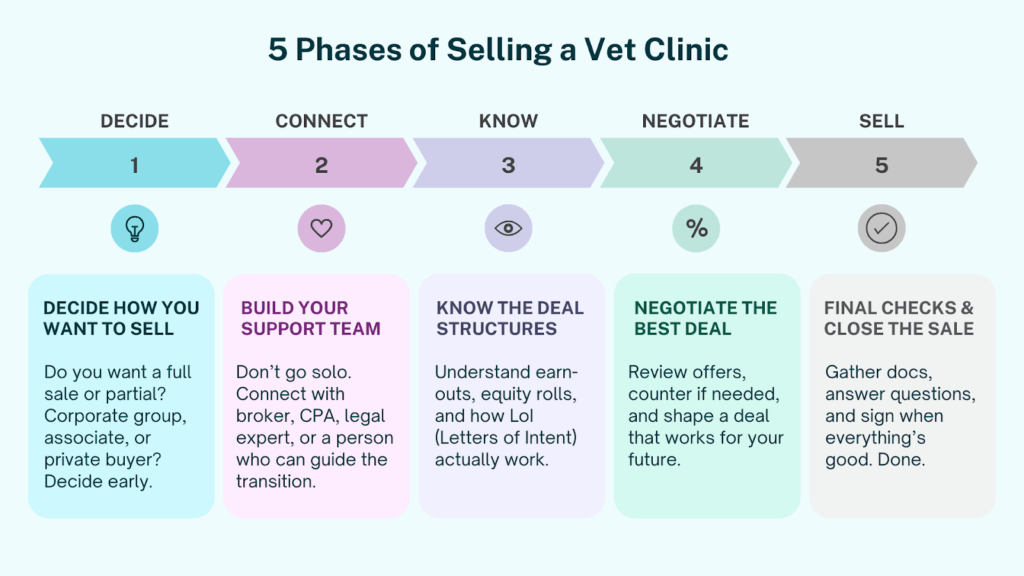

How to Sell Your Vet Clinic

For many veterinarians, selling a clinic is a first-time experience. You’ve built it, run it, and now you’re looking to move on. That’s not just a legal or financial decision. It’s a shift in responsibility, trust, and long-term planning.

It isn’t about rushing the process or guessing your way through it. Most vet practice sale advisors follow proper steps to help owners get the outcome they want without the pressure of figuring everything out at once.

1. Decide on the Sale Type

Before anything else, figure out what kind of exit works best for you. There are two ways to do this:

- Fast Track Sale: You stay as a practicing veterinarian or part-owner post-sale. Buyers love this, as it lowers their risk. Such deals can close in as little as 3 months.

- Full Exit: You’re handing over ownership entirely. Expect more back-and-forth, more questions, and a longer timeline. It gives you a clean break and often more negotiation power.

Next, think about who you’d ideally sell to. Corporate consolidators offer structure and deep pockets but often have a more rigid culture. Private buyers may offer a more personal approach, but the process can take longer. Associates might keep the clinic’s legacy alive, but they often need financing or seller support.

2. Evaluate the Vet Practice and Set a Strategy

It starts with an honest review of your goals and where your clinic stands today. It includes looking at financial performance, team structure, and culture. EBITDA is calculated to estimate value, but the goal isn’t just to price the business. It’s to identify strengths and gaps, so the clinic is well-positioned when buyers start looking.

This phase often shows you opportunities to clean things up. It could be documentation, staffing issues, profitability tweaks, or factors that could increase the valuation.

3. Hire the Right Team

A strong sale depends on the right people handling the right parts of the deal. It typically includes:

- A practice sale advisor, who manages the entire process. They’re not just finding a buyer. Their role includes valuation, deal design, buyer screening, confidentiality, and negotiation support. They remain involved through every step until the clinic changes hands.

- A CPA (Certified Public Accountant), who prepares normalized finances, helps with tax planning, and presents the clinic’s numbers clearly and consistently.

- A lawyer, who structures the agreement and ensures the terms protect your interests throughout and after the sale.

4. Share the Clinic Quietly With the Right Buyers

The clinic is never posted on public listing sites. Instead, it’s introduced to a select group of pre-vetted buyers that are known for valuing medical standards, cultural fit, and legacy. This “quiet marketing†approach creates demand without disrupting the business. A competitive bidding process often follows, helping drive up value while keeping control in the seller’s hands.

5. Review Offers and Find the Right Match

Offers aren’t just evaluated on price. Each one is reviewed for alignment with your values. For example, how staff will be treated, what changes might follow the sale, and how the new owner plans to operate. The process is more about making sure the clinic continues to run well and that the legacy you’ve built carries forward under the right hands.

6. Negotiate Terms and Sign the LOI

Once you select the preferred buyer, the advisor leads negotiation on the LoI (Letter of Intent). This includes deal terms, tax structure, timeline, and your role after the sale. Rather than pushing for a quick close, the advisor’s job is to get the right terms and protect you legally and financially before anything is finalized.

7. Support Through Diligence and Closing

As the buyer begins their formal review, your advisor manages the process and keeps the veterinary practice transition plan ready. The phase generally includes reviewing financial records, contracts, staffing details, and more. Most sales close in about 3 to 4 months when the groundwork is done properly. The advisor stays involved until every document is signed and the money clears.

8. Transition On Your Terms

After the sale, many veterinarians continue practicing without the stress of ownership. Others consult, support the team short-term, or step into full retirement. Each transition is different, and that’s by design. The advisor works with you to define your role. Be it clinical, operational, or none at all, so you’re clear on how the next phase looks before you hand over the keys.

Exit Checklist for Vet Clinic Owners Preparing to Sell

- 3 Years of Financial Statements (Clean and Reviewed)

- Normalized EBITDA Calculated

- Staff Contracts and Roles Defined

- Tax returns, payroll, AR/AP

- List all Debts, Liabilities, and Loans

- Updated Equipment and Inventory List

- Lease/Property Documents Prepared

- Professional Valuation Report (Optional but Recommended)

- Buyer NDA Template and Teaser Summary Ready

- Retirement/Tax Strategy Discussed with CPA

- Post-Sale Role Agreed and Documented

- Client & Staff Communication Plan Drafted

The Right Deal Starts With the Right Team Behind You

We rally the best buyers, manage the entire sale, and deliver excellent outcomes for multi-veterinary practice owners. With our exclusive buyer network and proven selling process, you’ll walk away with the best deal, the right terms, and a future you control.

Inside the Buyer’s Mind: What Gets Their Attention

When you’re preparing for a sale, timing plays a larger role than most expect. The state of the market can shift the type of buyers you attract, the pace of the deal, and the price on the table.

Here’s what’s shaping vet practice sales right now.

Clean Operations Matter More Than Location Alone

A few years ago, urban clinics attracted top dollar simply because of their zip code. That’s changed. Buyers are now favoring clinics that are well-staffed and undeviating, even if they’re in smaller or mid-tier markets. A busy, organized clinic in a regional city may now outperform a visibly busy but stretched practice in a major metro.

External Factors Are Changing the Math

Interest rates, staffing shortages, and regional growth patterns are now affecting what buyers are willing to pay. When borrowing becomes expensive or hiring is uncertain, buyers lean toward lower-risk deals, which are usually clinics that require fewer changes and no urgent hiring.

Timing Can Tip the Scale

If your clinic is well-run and your books are in order, paying attention to market shifts can work in your favor. The right timing won’t make up for weak operations, but it can give you leverage and shorten the path to closing.

| Please note that the: ✅Buyer interest is still strong, but has become more selective Veterinary clinics are still in demand. And buyers are still active, but they’re more selective now. Clinics with strong internal systems, multi-veterinarian teams, and low turnover tend to get attention first. If your practice runs efficiently and doesn’t rely heavily on you to hold it together, the probability of securing a good deal goes up. ✅Expectations of corporate and private equity groups have shifted Groups backed by private equity still have capital to spend, but they’re not rushing in like they did a few years ago. They’re being cautious, asking more from sellers, and walking away if the numbers aren’t good enough. Well-organized clinics with strong systems and consistent earnings are more likely to reach the upper end of the valuation range. |

Mistakes to Avoid When Selling a Veterinary Practice

| Emotional Pricing: It’s easy to overprice when the clinic feels personal. But inflated expectations can drag out the sale or scare off good buyers. Let your financials and real valuation guide your pricing. No Tax Planning: A strong sale price loses its shine if your tax burden eats a huge portion. Work with a CPA who understands practice sales and exit strategies before you finalize anything. Relying on One Buyer: Deals fall through. You lose time and leverage if you only talk to one buyer and things stall. Keep your options open until contracts are signed. |

What Happens After You Sell Your Vet Practice Clinic?

| Post-Sale Involvement Options: Some sellers stay part-time to help transition. That could mean working a few days a week or acting as a paid consultant. This allows the new owner to settle in and gives staff and clients some continuity. Consulting Roles & Agreements: If you stay on, define your role in writing. Agree on how long you’ll be there, what you’ll do, and what your decisions are yours. Avoid informal, open-ended roles, which often create tension or confusion. Letting Go the Right Way: Stepping away after years of ownership can be emotionally challenging. Preparing mentally for the handover is just as important as the legal side. A clean exit doesn’t mean disappearing overnight. Instead, it means leaving the new owner prepared and the clinic in proper order. |

Final Thoughts

Selling gets harder when you leave planning too late.

Leaving a practice you built from the ground up isn’t simple, even when the timing feels right. It’s about handing over something you’ve shaped for years and ensuring it’s left in good hands. Vet practice owners who take time to prepare their operations, financials, and team stand a far better chance of walking away proud of the transition they created.

So, start early, even if you think a sale is years away. Getting small things right now can save months of stress later. The good news is you don’t have to figure it all out alone. Bring in outside help or opt for reputed veterinary practice sales services that can manage every part of the sales journey. Right from preparation to due diligence and closing.

Selling your vet practice isn’t the end of the story. Done right, it’s the continuation of everything you built on your terms.

Selling your vet practice isn’t something you sort out after the offers arrive.

Without the right strategy, most vet owners lose 30 – 40% of what their practice could have sold for. We help sell your clinic to serious buyers, push offers higher, and secure the terms you need because a strong practice deserves a nice exit.

FAQs

What is veterinary sales?

Veterinary sales here means transferring ownership of a veterinary clinic, including its client contracts, staff, systems, brand reputation, and often the physical property. It’s different from selling pet medications, products, or supplies.

What is a good profit margin for a veterinary practice?

A profit margin between 10% and 18% is considered strong for veterinary businesses. Clinics in this range attract better offers because they show efficient management and financial stability.

How to market a veterinary practice?

The safest way is confidential marketing through vet-specific financial advisors, qualified buyer networks, and experienced brokers who use established buyer databases. Avoid public ads to maintain client and staff trust.

What is the highest paid veterinary field?

Board-certified surgeons, emergency veterinarians, and veterinary cardiologists often earn the most. Executives managing multi-location veterinary groups also see significant compensation packages.

Leave a Reply